Now, no worries! Here comes the solution for this payroll update error 15241. Read this blog and we believe you can fix it on your own end. If still confused, talk to our experts. Anyways, we want your problem to get resolved.

QuickBooks Error 15241 may occur due to a simpler reason like FCS being disabled. There are many scenarios where this error might occur because of irreparable files or some problems with Microsoft Payroll Services. Users will have to step into the troubleshooting process in order to fix this error by rolling back a previous or updating the service in Windows ARPS or by reinstalling it.

What are the Causes of This Payroll Update Error 15241?

- QuickBooks Desktop File Copy Service (FCS) is not enabled. This service is indispensable for the functioning of QuickBooks application and payroll service.

- The downloaded file is corrupted

- Installation is not correct

- Corrupted windows registry files

- Malicious software attack

- If QuickBooks files get deleted

- If your computer is blocking you from accessing the file, it might be that the anti-virus program needs to be updated to allow access

Also Read: QuickBooks Payroll Error 6000

What are the Symptoms of QuickBooks Update Error 15241?

- If your program window has crashed down

- Windows run slowly and respond sluggishly to the mouse and keyword inputs

- If an update notification has been received in QuickBooks Payroll

- In case if the payroll update has not been installed

How You Can Resolve QuickBooks Error Code 15241?

Windows 8/7/Vista and Windows 10 Users need to follow the given activities –

- Shut down QuickBooks desktop

- “Windows Start” and then right-click on computer

- The user needs to click the ‘Manage’ tab

A User of Windows 10 needs to follow the given below steps –

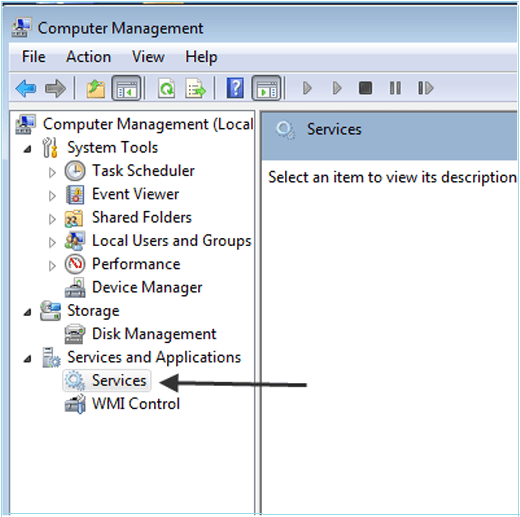

- Go to left pane, click on ‘Services’ and then ‘Applications’

- Go to the right pane, click on ‘services’

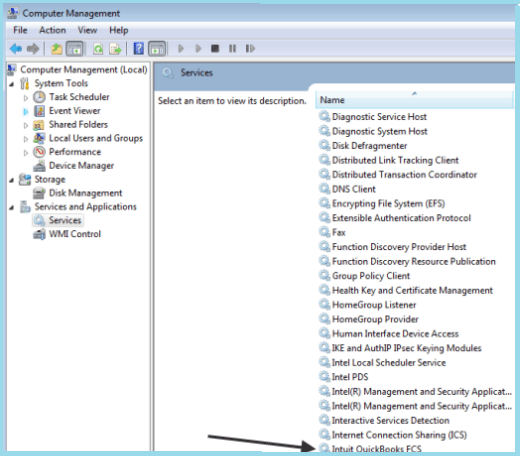

- Double click on ‘Intuit QuickBooks FSC’

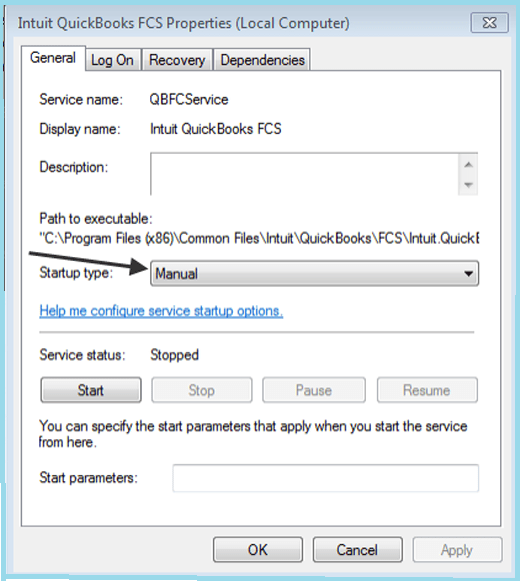

- Click on startup type drop-down

- Go to the start-up window and choose ‘manual’

- Choose ‘Apply’ button

- Select the start option and then click on OK button

- Go to QuickBooks desktop again

- Download the product updates for QuickBooks desktop

- Finally, you need to update latest payroll tax tables

Windows XP Users need to do the following things –

- Shut the QuickBooks desktop

- Right-click and then select ‘Manage’ option. A computer management screen will be visible

- Services>Application>Services. A pop up – the services window will be visible

- Open the Intuit ‘QuickBooks FCS ‘Properties window with double-click.

- You need to click on ‘General tab’ and then choose ‘start-up’ type drop-down list and choose ‘manual’ option.

- Click on Ok

- Followed by opening QuickBooks desktop

- Updates for the QuickBooks desktop product are ready to download

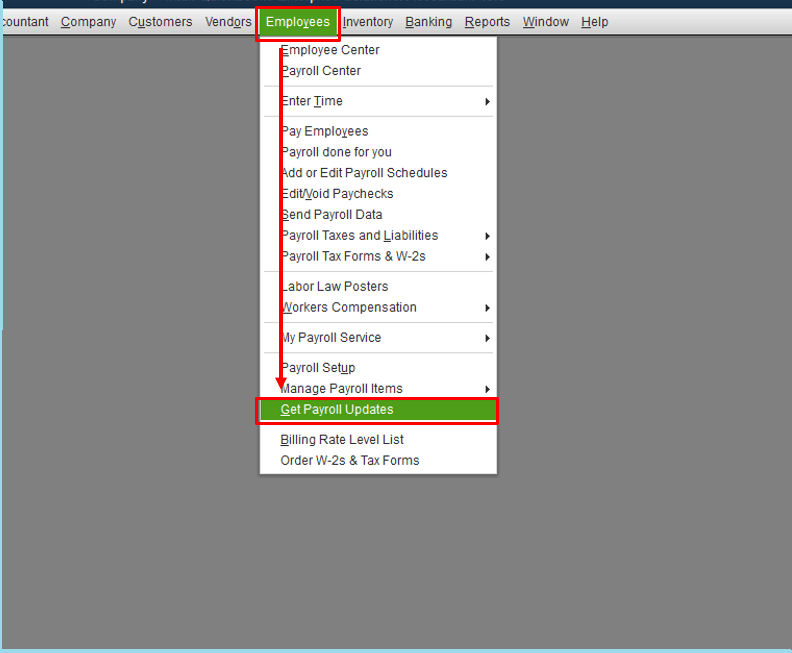

- Go to employees and then you have to click on ‘Payroll Updates’

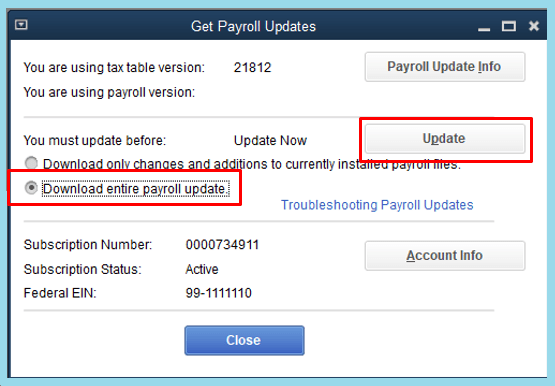

- Choose Download entire payroll update

- Choose ‘update’ tab

- A message will appear, ‘A new tax table or payroll update needs to be installed on your computer’

- Click on OK

You can easily set up your QuickBooks for automatic updates so you don’t have to worry about manually updating it the traditional way. Here is how to do it

- Tap on Help and choose ‘Update QuickBooks Desktop’

- Click on ‘option’ tab

- To turn on automatic updates, click on “Yes”

- Close the tab

Last Word:

If a user is attempting to install or update the latest payroll on his/her computer they may receive an error code of 15241 which indicates difficulty installing the payroll. In addition, there are a number of factors that lead to most of these errors such as damaged installation files (due to Microsoft Windows Installer), damaged-payroll installation files, and paid employees’ information. We hope this blog may help you fix this error.

FAQ’s

How a Payroll tax table can be updated?

- On QuickBooks, go to employees menu

- Choose an option, ‘Get Payroll Updates’

- A checkbox will appear, ‘Download entire update’. You need to click on that

- Choose button update

- On the screen, full download will appear

- The payroll tax table will be updated completely

How you can set the preferences in QuickBooks

- Move to the Edit menu in QuickBooks

- Choose the preferences button

- Click on the Graphs and Reports

- Click on ‘My Preferences Option’ tab

- Check the report

- Go to Modify report option

- When the report is created, a modify window automatically opens up

- To confirm it report the preferences

- Now it is done